本识洞见 | 香港交易所2024年ESG披露审查:关键气候目标合规率达 91%

The Stock Exchange of Hong Kong Limited (the Exchange) has published its 2024 review of listed issuers’ ESG reports, showcasing over 91% compliance across most ESG aspects and significant advancements in governance and climate-related disclosures. As new climate requirements loom, companies are urged to gear up for stricter regulations.

香港联合交易所有限公司(联交所)发布了其对上市公司 ESG 报告的 2024 年审查报告,显示在大多数 ESG 方面合规率超过 91%,且在治理和气候相关披露方面取得了显著进展。随着新的气候要求迫在眉睫,企业被敦促为更严格的法规做好准备。

Strong Compliance Across ESG Aspects

ESG 各方面的高合规率

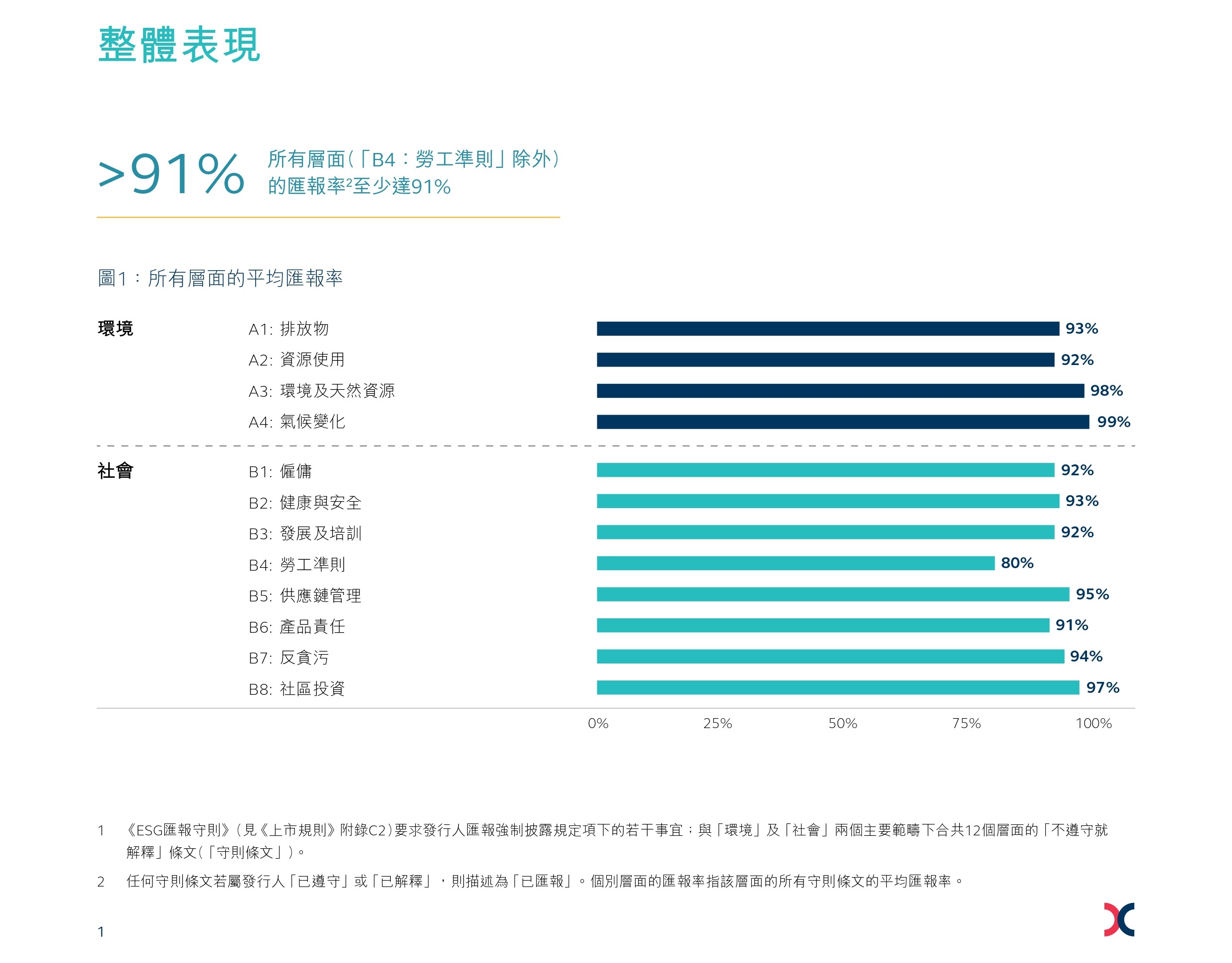

The review reveals high reporting rates, with compliance exceeding 91% in most areas, including emissions (93%), climate change (99%), and community investment (97%). However, labour standards lagged behind at 80%. Companies have enhanced ESG governance by clearly defining board responsibilities, integrating ESG strategies into decision-making, and increasing engagement between boards and ESG committees. These steps underscore a growing focus on accountability and transparency in sustainability efforts.

审查显示报告率很高,在大多数领域合规率超过 91%,包括排放(93%)、气候变化(99%)和小区投资(97%)。然而,劳工标准落后,为 80%。企业通过明确界定董事会职责、将 ESG 战略纳入决策过程以及加强董事会与 ESG 委员会之间的互动,加强了 ESG 治理。这些举措突显了企业在可持续发展努力中对问责制和透明度的日益重视。

Climate Readiness Among LargeCap Issuers

大盘股发行人的气候应对准备情况

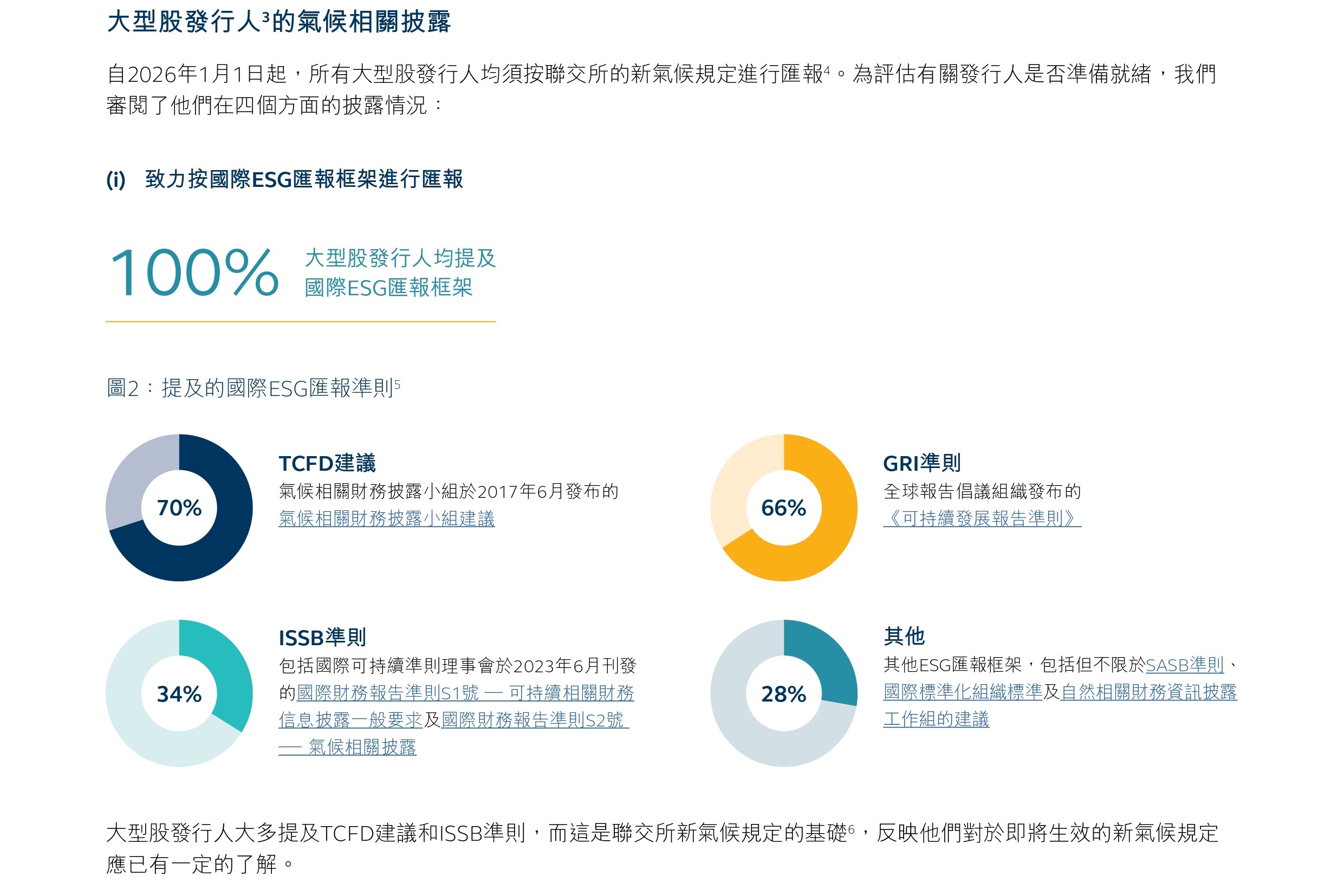

LargeCap Issuers, representing Hang Seng Composite LargeCap Index constituents, have shown strong alignment with international frameworks, with 100% referencing global ESG standards like TCFD Recommendations (70%) and ISSB Standards (66%).

代表恒生综合大型股指数成份股的大盘股发行人已显示出与国际框架的高度一致性,100% 参考了全球 ESG 标准,如气候相关财务披露工作组(TCFD)建议(70%)和国际可持续发展准则理事会(ISSB)标准(66%)。

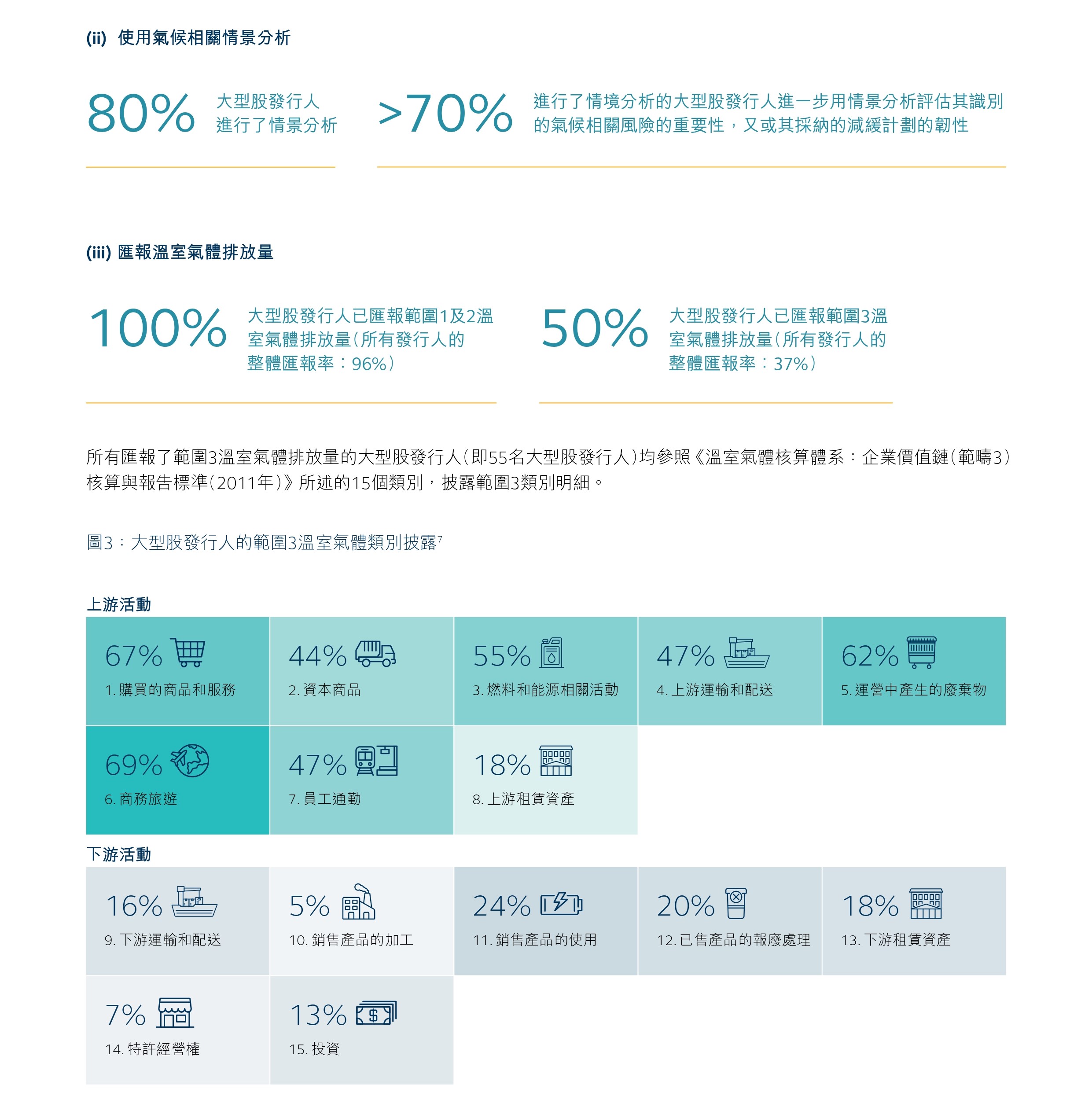

Furthermore, 80% conducted scenario analyses, with over 70% assessing climate risk materiality and mitigation resilience. While all disclosed Scope 1 and 2 GHG emissions, only 50% reported on Scope 3 emissions, focusing on upstream activities like business travel (69%) and purchased goods and services (67%). Downstream activities remain underreported due to limited control over customers’ behaviors.

此外,80% 的企业进行了情景分析,超过 70% 的企业评估了气候风险的重要性和缓解弹性。虽然所有企业都披露了范围 1 和范围 2 的温室气体排放,但只有 50% 的企业报告了范围 3 的排放,主要集中在上游活动,如商务旅行(69%)和采购的商品及服务(67%)。由于对客户行为的控制有限,下游活动的报告仍然不足。

Preparing for Future ESG Regulations

为未来 ESG 法规做准备

Ahead of the Exchange’s new climate requirements, effective January 2026, issuers are advised to take proactive steps. Companies should familiarize themselves with the latest ESG guidance, engage supply chain partners for robust data collection, and allocate sufficient resources. Conducting gap analyses to identify areas for improvement and setting long-term quantitative targets, aligned with regional carbon neutrality goals (Hong Kong: 2050, China: 2060), are essential priorities.

在联交所 2026 年 1 月生效的新气候要求之前,发行人应采取积极措施。企业应熟悉最新的 ESG 指南,与供应链合作伙伴合作以确保数据收集的稳健性,并分配足够的资源。进行差距分析以确定需要改进的领域,并设定与区域碳中和目标(香港:2050 年,中国:2060 年)相一致的长期定量目标,是至关重要的优先事项。